Social Security is one of the few income sources that keeps up with inflation and lasts for life. But most women fail to maximize their benefits because they don’t understand the little-known rules that can help them get more out of the system.

This workshop will cover:

• How much Social Security you stand to receive over your lifetime

• How the decisions you make in your 60s can determine the amount of income you’ll have in your 80s

• How to take advantage of spousal benefits, survivor benefits, divorced-spouse benefits, and even divorced-spouse survivor benefits

• Why women who are married should make the decision about when their husbands should apply for Social Security

• Why you should consider your husband’s life expectancy when deciding when to claim your own retirement benefit

• What to do if your husband or ex-husband dies or if your marital status changes

How to plan for the extra-long life

This workshop is for women, as well as for men who have women in their lives (wives, sisters, mothers). It features essential information all women need to have if they are concerned about financial security in retirement.

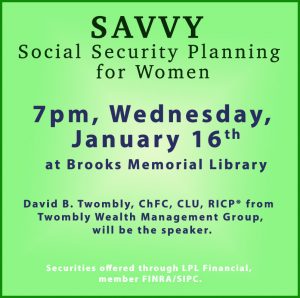

Seating is limited and reservations are recommended. Reserve space by calling (802)254-5290 ext.1201. David B. Twombly, ChFC, CLU, RICP® from Twombly Wealth Management Group will be the speaker. Securities offered through LPL Financial, Member FINRA/SIPC.